The UK has reached a defining moment for its digital economy, introducing legal clarity that crypto users and businesses have long sought. For a long time, cryptocurrencies, stablecoins, and other digital tokens existed in a grey legal zone, recognised by courts in practice but not formally defined in statute.

That uncertainty shaped how disputes were settled, how assets were recovered, and how companies approached innovation. Now, with Parliament passing the Property (Digital Assets, etc.) Act and securing royal assent, the UK has made a deliberate shift toward a more structured digital asset framework.

The new rules are designed to do more than refine legal language. It is believed that they will help how English law categorises emerging technologies, laying the groundwork for clearer ownership rights, smoother dispute resolution, and broader institutional participation.

UK Issues Digital Assets Firm Legal Ownership Status

The legislation confirms that digital or electronic “things” qualify as personal property, placing cryptocurrencies on the same legal footing as traditional assets.

Previously, courts treated crypto as property through case-by-case rulings, relying on common law. Parliament’s decision now writes this position into statute, following a 2024 recommendation from the Law Commission.

Digital assets had long challenged existing classifications. UK law traditionally recognised two forms of personal property: physical items (“things in possession”) and enforceable rights (“things in action”).

Crypto fits neither category neatly. The new law resolves this by creating space for a distinct type of property that reflects how digital tokens behave and are used in modern markets.

Industry groups welcomed the change, stating that it will help courts deal with theft, fraud, insolvency, and inheritance cases involving crypto with greater consistency. Users now have a clearer pathway for proving ownership and recovering lost or stolen digital funds.

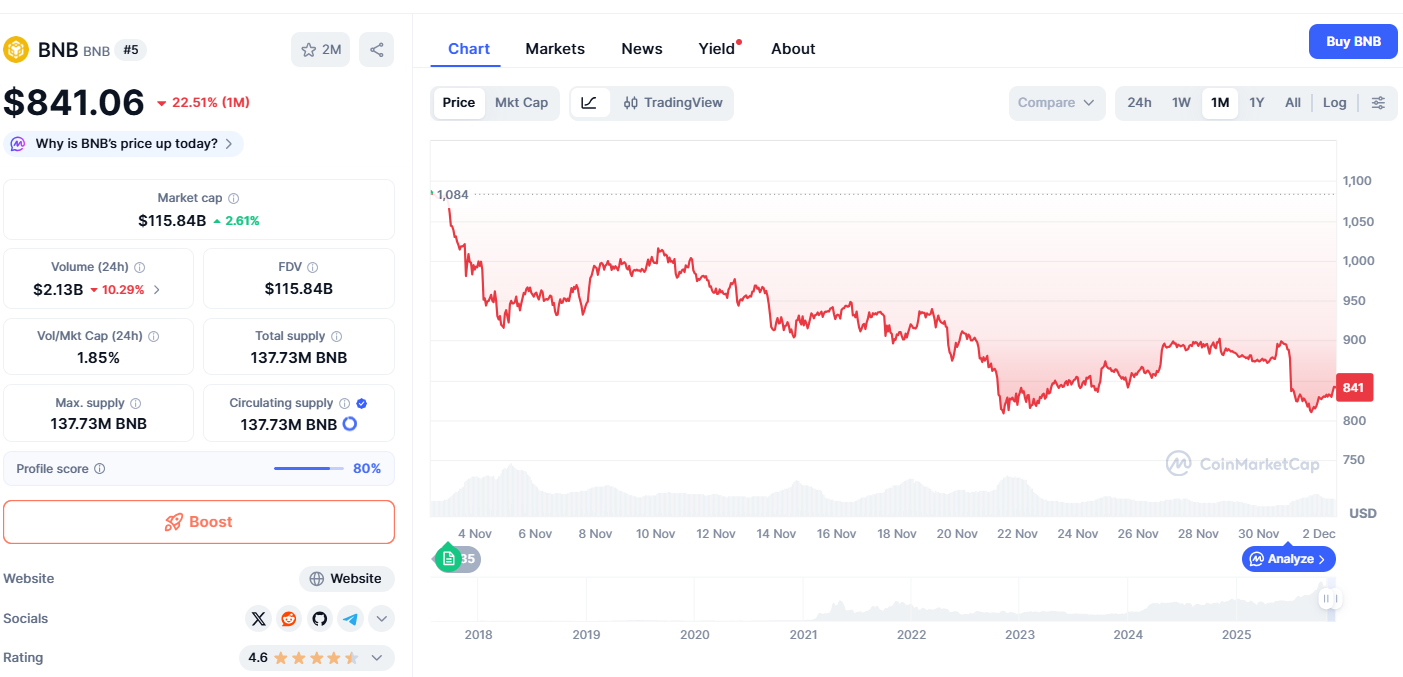

Stronger Protections as Adoption RisesThe shift arrives as crypto participation continues to grow in the UK. According to financial regulators, around 12% of adults now hold some form of crypto, up from 10% in earlier findings. Policymakers have argued that this rising adoption makes legal certainty essential for both consumer protection and market stability.

The new statute also aligns with the government’s broader plan for a regulated crypto regime that would bring exchanges and service providers under rules similar to those applied to traditional financial firms. Lawmakers aim to support innovation while introducing clear standards for accountability.

Cover image from ChatGPT, BTCUSD chart from Tradingview

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments