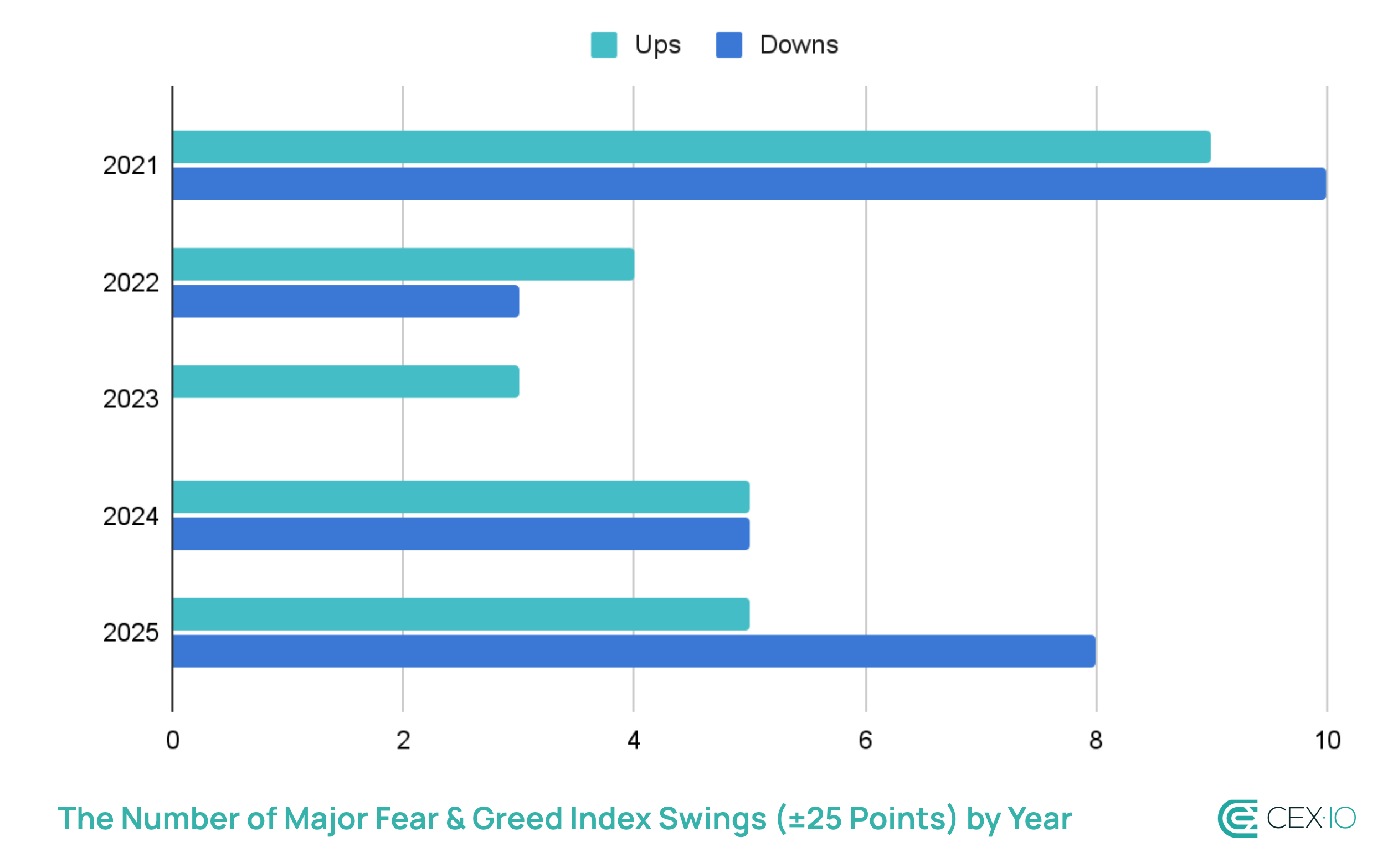

Recent panic selling suggested Bitcoin lost its store-of-value status, citing a "near-zero link" to gold. That narrative ignores the deep structural data. BTC is following gold's path, but its superior liquidity makes it the first asset sold in a panic, confirming its efficiency, not failure.

The core conviction is that verified, non-speculative scarcity demand now dictates market structure. Knowledge is the real flex here.

1) Fundamental Correlation Lock: BTC's correlation with Gold stands above 0.85, a dramatic increase from the -0.8 observed in 2021. This high correlation confirms the long-term institutional valuation thesis of BTC as a primary store of value.

2) Institutional Supply Shock: BlackRock's IBIT contributed $477M in net ETF inflows, confirming routine, systematic allocation from large asset managers. This "sticky" capital provides a deep structural floor for Bitcoin.

3) Liquidity Paradox: The temporary price action where "BTC down first, gold lags" is simply due to BTC being the most liquid digital risk asset, confirming its efficiency. The long-term alignment overrides this temporary behavioral divergence.

The conflict is simple: Is the structural correlation the only truth for long-term allocation, or should investors hedge against the short-term liquidity anomaly that still causes price divergence?

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments